An Excellent Look At Small Company Loans For New Startups

Content by-Poulsen Glerup

Bad Credit Scores Small Company Loans In 2021: Begin First, Return On Track. Negative credit score small business startup finances are the best means to kick-start your local business. With a poor credit report, you may have had problem obtaining standard funding from financial institutions in the past. Nonetheless, bad credit small business loans can assist you obtain your organization up and running, by supplying you with a tiny financing based upon your individual credit ranking and also business plan.

Many financial institutions, credit unions, as well as other banks offer small company startup fundings without any individual assurances. This suggests that if you fail to make your car loan settlements, it's not the financial institution's fault. Unfortunately, several business owners and also small business proprietors choose to go this course, not recognizing the threat of individual warranties are not worth it for their companies.

With small business loans, there are a number of options to consider. While there are typical banks that use these fundings, you might also want to check out the options offered with neighborhood as well as online loan providers. While there are a few distinctions between on-line loan providers and also your local financial institution, they can be an useful source for your service. Below are some ideas to assist you discover the best bank loan on the internet and also avoid usual blunders with your fundings.

Search For Financing Alternatives - Research various funding options. If you are searching for bank loan with bad debt, you will certainly need to look around. Different loan providers provide different funding options. Be sure to do your research to ensure that you receive the most effective price as well as terms for your bank loan.

Get Pre-Offer Files - A lot of lenders will certainly call for customers to submit numerous kinds and also paperwork prior to providing them a financing. These kinds and also documents are utilized as collateral to secure the finance. In some cases, debtors are not asked to send any type of documents, but loan providers might ask for copies of individual credit rating reports, company credit rating records, and so forth. You will wish to contrast various lending institutions to figure out which ones offer the most affordable prices for your funding requires.

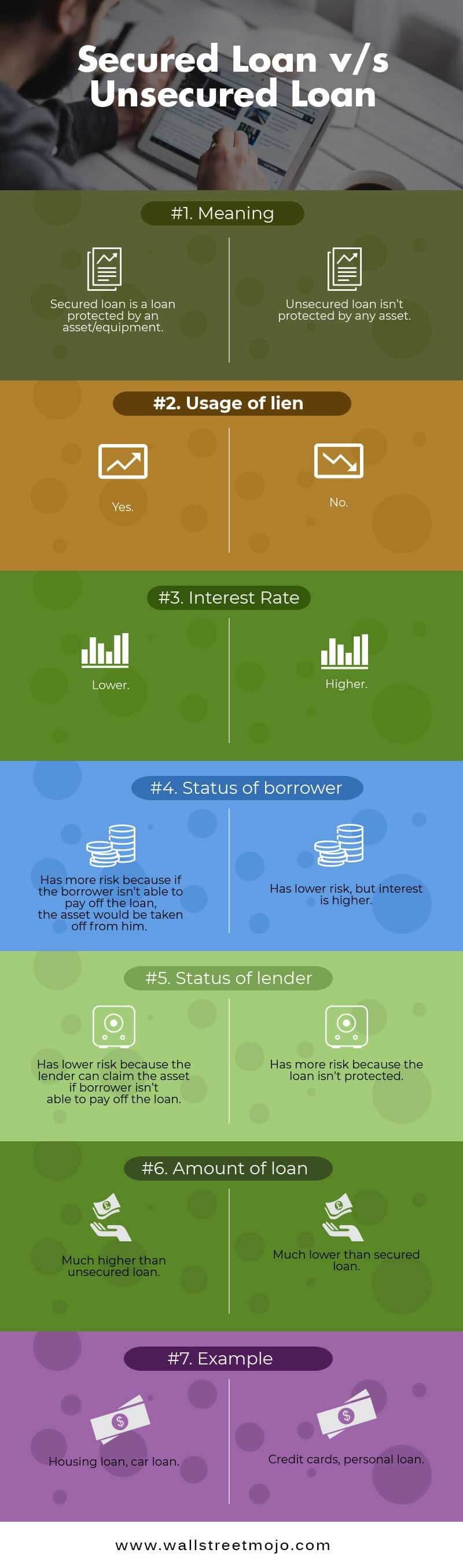

Acquire Angel Investors - There are numerous investors around that agree to purchase your startup or existing businesses. You may be able to obtain funding from a private investor, yet be aware that this sort of financing includes additional due diligence with your loan provider. Lots of small-business start-up lendings are not secured by any type of sort of properties, that makes getting resources from angel capitalists a difficult obstacle for many small-business proprietors.

Think about Collaborating With a Lender That Approves Bad Credit Applications - There are numerous financing alternatives offered, but few lenders handle bad credit scores finances. If you have the ability to protect a car loan with a secure company, there is a good chance that you will have the ability to acquire a competitive rate. If you have negative credit rating, however, you may require to think about making an application for personal credit rating simply to prove that you can take care of a small company. This will aid you verify that you are capable of meeting financial responsibilities even if you have bad credit history.

If you have an interest in small-business start-up finances, there are many options readily available to you. Some of these options include conventional financial institutions, lending institution, private lenders, venture capitalists, as well as angel investors. In many cases, you must contact your neighborhood bank to ask about obtaining funds for your organization. You may likewise require to submit a formal business strategy to provide to a lender to make sure that they can evaluate your financing offers.

Company startups are on the rise, and many individuals are struggling to get a foothold in the industry. Regrettably, what is a uncollateralized loan that have bad credit rating are commonly turned away from funding alternatives merely because of their past economic history. Therefore, many start-ups fail to make it since they do not fulfill the requirements needed by their possible lenders. However, https://drive.google.com/file/d/1VpcUgPfw--auBBcLuyI0LJslQky9reP7/view?usp=sharing is feasible for those with a bad credit report to get start-up car loans. All that it takes is an innovative service suggestion that can create income.

If you are preparing to apply for start-up service fundings, you need to first put together a well-written service strategy. Your plan ought to consist of a detailed summary of your startup venture, your future projected incomes, and also your expected expenditures. To guarantee that you are given with the most effective rates of interest, do as much research study as feasible prior to speaking to different lenders. Check out a range of lenders and locate the one that finest suits your loan needs. Call numerous lenders in order to discover more about the various car loan products used. When you have actually narrowed down your search, speak to the loan providers with the very best deals.

The success rate of new businesses that are given startup company lendings is rather high. However, there are particular qualification requirements that you must accomplish so as to get approved for a loan. Numerous loan providers need start-up companies to be operated entirely offline, meaning that none of the business is run online. Furthermore, the majority of lending institutions call for that the startup is located in a details geographical area. No matter your start-up's qualification requirements, looking for startup organization finances is a superb method to acquire monetary aid for the brand-new businesses that you mean to start.